Video: Key Questions for a Securities Crowdfunding Round.

If you are raising money in a securities crowdfunding offering, you have multiple options as to how you pursue a funding round.

First, you choose a securities exemption; Reg CF, Reg A+, or Reg D 506c. Reg CF allows an issuer to raise up to $5 million, Reg A+ up to $75 million, and Reg D an unlimited amount of money but only from accredited investors.

See: Crowdfunding Securities Exemptions Explained.

If you are using Reg CF, you must list your securities offering with either a Funding Portal or Broker-Dealer – both regulated by FINRA. So what is the difference between using a Funding Portal or Broker Dealer?

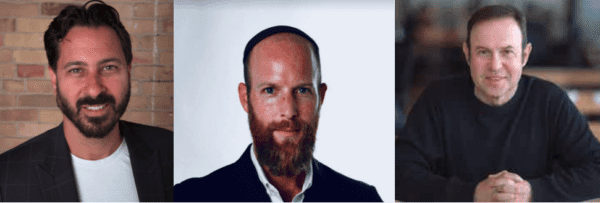

Recently, CI held a webinar to talk about key considerations for an online private securities offering. The panelists included Howard Marks – CEO of StartEngine, Etan Butler – Chairman of Dalmore Group, and Matt Goldstein – CSO & co-founder of DealMaker. Each of these platforms is affiliated with a broker-dealer, and StartEngine also operates a Funding Portal. They are also some of the largest platforms providing online capital formation services.

Asked about the advantages of operating a Funding Portal, Marks explained the benefits of using his platform as being their expertise and the number of users. He said that typically half of the money comes from the entrepreneur’s connections, with half coming from his registered users or StartEngine’s community.

“Congress created the Funding Portal as a “light” Broker Dealer,” said Marks. “The amount of due diligence we have to do as a Funding Portal is less than a Broker Dealer. For example, we can rely on the statements a CEO makes.” Of course, these statements must be true and valid.

Marks added that, importantly, there is a cost difference for the issuer when it lists a securities offering with a Funding Portal as it costs the company less than a BD.

“The broker-dealer is a higher cost.”

Butler added that some Funding Portals have been successfully able to amass a good amount of users, which can be potential investors in a securities offering.

“You can get the chance to benefit from using their community.”

Butler said, in contrast, if you list a securities offering on your own page – you can be the sole beneficiary of the success of your offering, keeping all of the affiliated data and information.

Butler explained that Dalmore enables a company to list a Reg CF offering on their own domain with the caveat that the Broker-Dealer MUST control the page. The Broker-Dealer must also ensure that all of the disclosures and disclaimers are included, but the net result is the investor sees a website owned by the company raising the money.

Goldstein said that certain Funding Portals are going to be the right choice for some issuers. A community on a Funding Portal may match the attributes or ambitions of a specific issuer.

“You have to think about who your buyer is and how you want to reach them … What is the best strategy for you?”

Asked if his registered community has been effective for companies listing on the StartEngine Funding Portal, Marks said it is – once you look at their financial performance.

If you are launching a Reg A or Reg D – you do not need a Broker Dealer, but many people choose to use a Broker Dealer, explained Butler. Why should you use a Broker Dealer? Because it is a regulated entity that performs due diligence, that makes certain the investments are suitable and provide added value beyond that. You can also provide investment advice (Dalmore does not do this), and a Broker Dealer is able to solicit, whereas a Funding Portal cannot.

A Broker Dealer can also syndicate an offering, something a Funding Portal is not allowed to do, said Butler.

Dealmaker’s model is to set up all offerings for success. As a Broker Dealer, they simply provide an issuer the ability to “unlock an ability to sell in every state,” shared Goldstein.

Register Here for Next Webinar: Managing Risk in a Private Securities Offering

What about Offering Documents? Auditing? Attorneys? And more – like marketing. All three platforms have relationships with people who can help with these services. Dealmaker, StartEngine, and Dalmore all assist with a cafeteria-type service providing a one-stop shop for firms raising money online. Some platforms will also offer marketing services.

“A lot of the issuers that come in are not experts in crowdfunding,” said Marks. They understand their business. Crowdfunding is our expertise. “We would like to simplify it.”

“Our model is to observe what has been working well and not so well for issuers,” said Butler, adding that they have onboarded over 300 Reg A+ issuers benefiting from the experience. “We see a lot of issuers that start on a marketplace platform, but unfortunately does not always work out so well.”

Butler noted that there are over 80 to 90 Funding Portals, but only a few of these platforms are doing significant business.

So each platform provides a one-stop service for raising money online.

Fees. An important question for companies raising money online may be charged fees differently if the offering is listed on a Funding Portal or Broker Dealer. Different fees may be charged depending on the exemption utilized. At the same time, additional or tangential services are completely separate.

To learn more about raising money online in a securities crowdfunding offering, you may watch the video below.